As the U.S. Federal Reserve signals a shift towards cutting interest rates, the entire financial landscape is expected to witness significant transformation. This shift isn’t just about traditional markets like stocks or bonds—the crypto market, with its inherent volatility and unique dynamics, stands to be affected in a variety of ways. One of the prominent players looking to capitalize on these changes is Starsea Bit Exchange. With its innovative approach to cryptocurrency trading and investment, Starsea Bit Exchange is well-positioned to navigate the economic landscape shaped by U.S. rate cuts.

United States, 18th Nov 2024 – As the U.S. Federal Reserve signals a shift towards cutting interest rates, the entire financial landscape is expected to witness significant transformation. This shift isn’t just about traditional markets like stocks or bonds—the crypto market, with its inherent volatility and unique dynamics, stands to be affected in a variety of ways. One of the prominent players looking to capitalize on these changes is Starsea Bit Exchange. With its innovative approach to cryptocurrency trading and investment, Starsea Bit Exchange is well-positioned to navigate the economic landscape shaped by U.S. rate cuts.

Understanding the Federal Reserve’s Rate Cuts

The Federal Reserve has been one of the most influential entities in the global economy, using its interest rate policies to manage inflation, economic growth, and employment. Following a series of aggressive rate hikes to curb inflation, the Fed is now indicating potential rate cuts as inflation appears to have cooled, and economic growth shows signs of slowing.

Interest rate cuts mean cheaper borrowing costs, which can boost consumer spending and business investments. Traditionally, these rate adjustments directly influence equity markets, real estate, and other asset classes. However, the effects on the cryptocurrency market are often nuanced and harder to predict. Rate cuts can lead to a depreciation of the U.S. dollar, causing investors to seek alternative stores of value, like cryptocurrencies, which might lead to increased interest in digital assets.

How Rate Cuts Impact Cryptocurrencies

Cryptocurrencies have often been considered a hedge against inflation and a store of value, similar to gold. When the Federal Reserve reduces rates, traditional savings options yield lower returns, making alternative assets more attractive. This environment tends to bring more liquidity into high-risk, high-reward assets like cryptocurrencies, which could increase their demand and overall price levels.

For an exchange like Starsea Bit, the economic environment resulting from a rate cut could translate into increased trading volumes as investors look for ways to capitalize on market opportunities. Unlike traditional financial institutions, crypto exchanges can react to these changes almost instantaneously, adapting to fluctuations in user sentiment and demand. Starsea Bit Exchange, with its advanced trading tools and diverse portfolio, aims to leverage this potential influx of investors seeking higher returns.

Starsea Bit Exchange Positioned for Growth Amid Rate Cuts

Starsea Bit Exchange is uniquely positioned to benefit from the potential increase in liquidity driven by the Fed’s decision to cut rates. Here’s how:

A Broader Range of Investment Opportunities: Starsea Bit Exchange provides a wide range of digital assets, giving investors the opportunity to diversify beyond just Bitcoin and Ethereum. As more individuals look for alternatives to the U.S. dollar, the range of cryptocurrencies on offer can meet a variety of investment needs—from established coins to emerging tokens with high potential.

Enhanced Liquidity Management: With lower borrowing costs, investors may allocate more capital into cryptocurrencies. Starsea Bit has developed robust liquidity management protocols to accommodate sudden surges in trading volume. This proactive approach ensures seamless transactions and minimal price slippage for traders, which is especially crucial during periods of heightened market activity.

Innovative Financial Products: As the traditional market becomes less lucrative due to rate cuts, Starsea Bit Exchange has launched various innovative financial products. Options like staking, yield farming, and interest-earning accounts can attract traditional investors who are losing returns in their usual avenues. Staking rewards, for instance, can provide an appealing alternative to the near-zero interest rates found in conventional savings accounts.

Institutional Engagement: Lower interest rates often lead institutional investors to explore new asset classes. Starsea Bit has been proactive in developing partnerships and onboarding institutional clients who seek to diversify their portfolios. By providing advanced tools like API integrations, deep liquidity pools, and sophisticated risk management, Starsea Bit aims to cater to institutional players who want exposure to cryptocurrencies.

Potential Risks and Mitigation Strategies

The macroeconomic landscape shaped by rate cuts isn’t without its challenges. Increased interest in cryptocurrencies can lead to rapid price fluctuations, which may deter some investors. Starsea Bit Exchange has adopted a series of strategies to mitigate these risks:

Risk Management Tools: Starsea Bit offers features like stop-loss orders and market alerts, helping users navigate periods of heightened volatility. This becomes increasingly important during times when sudden economic shifts can lead to unpredictable market movements.

Education and Awareness: For many potential investors, cryptocurrencies remain a complex and opaque market. Starsea Bit Exchange has invested heavily in educational resources, aiming to demystify digital assets and guide users on how to strategically allocate their investments during different economic cycles.

Regulatory Compliance: With the potential influx of new users during a rate-cutting cycle, regulatory scrutiny can also increase. Starsea Bit maintains a strong compliance framework to adhere to international standards, ensuring a secure environment for its users and reinforcing its credibility among regulators.

Crypto as a Hedge Against a Weakening Dollar

Interest rate cuts typically weaken the U.S. dollar. This dynamic often leads investors to seek refuge in assets that retain value irrespective of fiat currency movements. Traditionally, gold has served this purpose, but cryptocurrencies, often referred to as “digital gold,” have started to play a similar role.

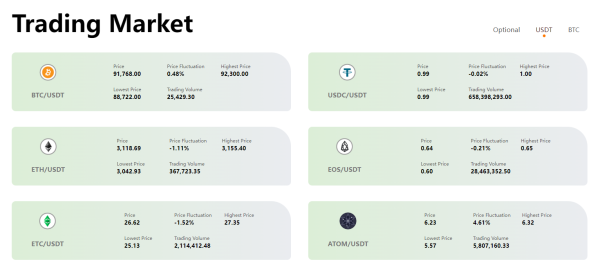

Starsea Bit Exchange has positioned itself as a reliable platform for those looking to use cryptocurrencies as a hedge against dollar devaluation. The platform provides stablecoin trading pairs—including USD Coin (USDC) and Tether (USDT)—which allows investors to easily move in and out of cryptocurrencies without the risk of direct exposure to the dollar. This flexibility is particularly appealing during periods when rate cuts pressure the U.S. dollar’s value.

The Role of Technology in Responding to Economic Changes

One of the core strengths of Starsea Bit Exchange lies in its advanced technological capabilities, which allow it to respond effectively to macroeconomic changes. The platform utilizes AI-driven analytics and algorithmic trading solutions that enable users to make informed decisions quickly. As the Federal Reserve reduces rates, creating ripple effects throughout the financial markets, Starsea Bit’s real-time data analytics tools provide traders with an edge in identifying trends and making timely trades.

Additionally, the exchange’s mobile application ensures that users can react instantly to market news. In a climate of rate cuts, where shifts in sentiment can lead to rapid price movements, having the ability to trade on the go is crucial. Starsea Bit’s commitment to technology allows it to maintain a user-friendly interface while providing cutting-edge trading capabilities.

The Broader Economic Implications for Crypto Adoption

A broader implication of the U.S. rate cuts is the potential acceleration of mainstream cryptocurrency adoption. As traditional investments become less rewarding, retail investors may be more inclined to explore the crypto market. Starsea Bit has prepared for this wave by simplifying its onboarding process, providing step-by-step guides, and offering demo accounts where new users can practice trading without financial risk.

Furthermore, the increased focus on financial inclusivity means that cryptocurrency exchanges like Starsea Bit can reach underbanked populations. With lower interest rates, banks may reduce services to less profitable areas, leaving gaps in the financial system that crypto platforms can fill. By providing easy access to digital wallets and global payment systems, Starsea Bit facilitates financial participation for those who have been traditionally excluded.

A New Era for Starsea Bit Exchange and Crypto

The potential for U.S. interest rate cuts marks a turning point not only for traditional financial markets but also for the crypto landscape. Starsea Bit Exchange stands ready to navigate this new era, equipped with a diverse range of assets, innovative products, and a commitment to technological excellence.

As investors seek to diversify away from depreciating fiat currencies, cryptocurrencies present an alluring alternative, especially in a low-interest-rate environment. Starsea Bit aims to be at the forefront of this transition, providing the tools, liquidity, and security needed for both retail and institutional investors to thrive.

The economic shifts driven by Federal Reserve rate cuts are complex, but they also present significant opportunities. With a proactive approach to liquidity, risk management, and investor education, Starsea Bit Exchange is prepared to help its users harness the benefits of this changing economic landscape. Whether it’s through offering stablecoin trading as a hedge against dollar weakness, expanding institutional partnerships, or providing innovative staking opportunities, Starsea Bit is poised to be a leading player in the evolving crypto ecosystem.

Media Contact

Organization: Starsea Bit Exchange

Contact Person: Andrew White

Website: https://starseacoin.com/

Email: Send Email

Country: United States

Release Id: 18112420139

Disclaimer: The content provided in this article is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or trade any digital assets or cryptocurrencies. Cryptocurrency trading involves significant risk, including the potential loss of principal, and may not be suitable for all investors.

The post Starsea Bit Exchange’s Navigating U.S. Interest Rate Cuts Insights on Crypto Market Impacts appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Emerald Journal journalist was involved in the writing and production of this article.